USDC Reserves Security Concerns Amid Sky’s $756M EOA Usage

The Context Behind Sky’s EOA and Its Connection to USDC Reserves Security

The recent concerns regarding Circle’s USDC stablecoin stem from Sky leveraging a high-value EOA worth $756 million—a move raising eyebrows among industry experts and investors. As an integral system in stablecoin liquidity and peg maintenance, such activity raises critical questions: How secure are these reserves? And what implications does this large-scale capital allocation entail?

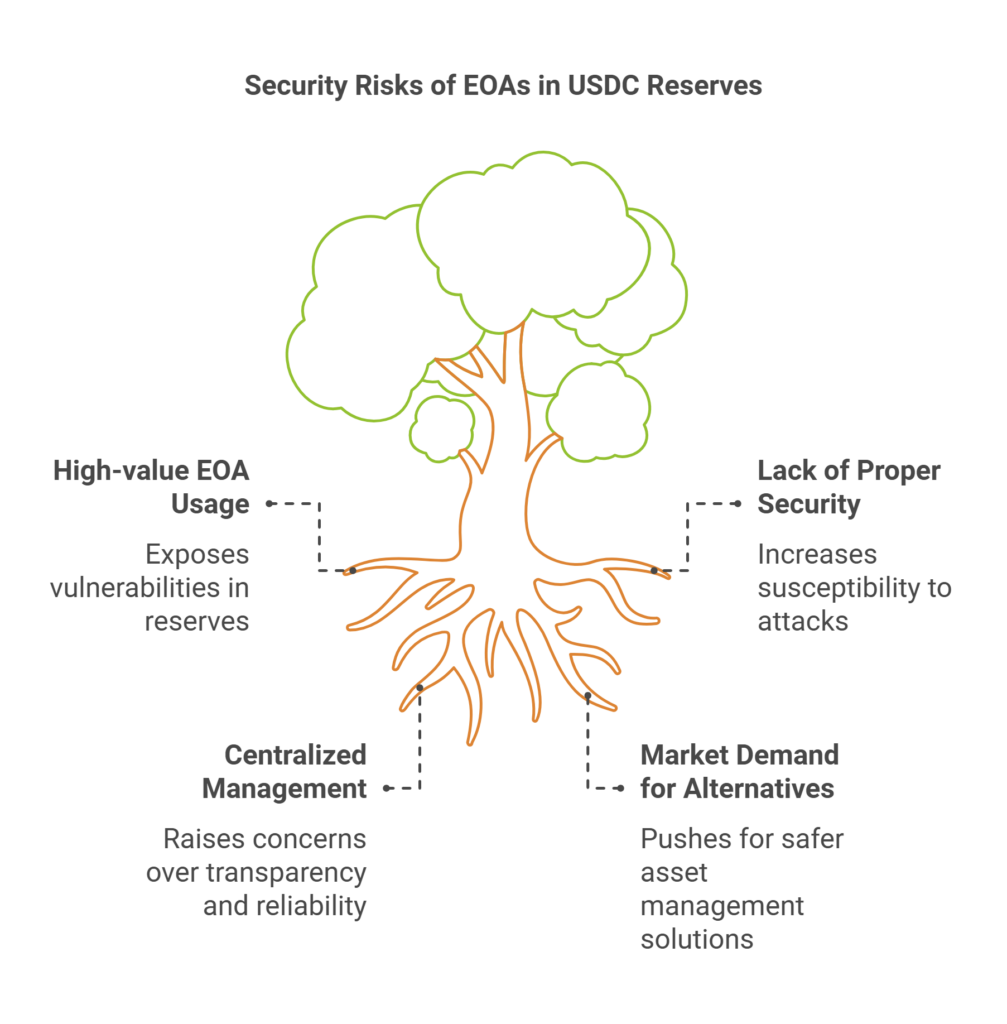

External ownership accounts (EOAs) are a standard feature of blockchain technology. However, their utilization at such a massive scale can potentially expose vulnerabilities in reserve-backed stablecoins like USDC. This has far-reaching implications for stablecoins’ transparency and reliability—two foundational pillars on which public trust is built.

Understanding How EOAs Could Threaten Stablecoin Security

EOAs are accounts controlled by private keys rather than contracts, which makes them susceptible to specific attack risks if not properly secured. With Sky employing an EOA for managing $756 million tied to the reserves of USDC, the potential risks cannot be ignored. A breach of these accounts could significantly impact the fund’s reserves and, as a result, the broader crypto market.

Given these risks, market participants and institutional investors are demanding further exploration into alternative systems that could reduce or eliminate the need for centralized EOAs for managing substantial assets.

Why USDC Reserves Security Matters More Than Ever

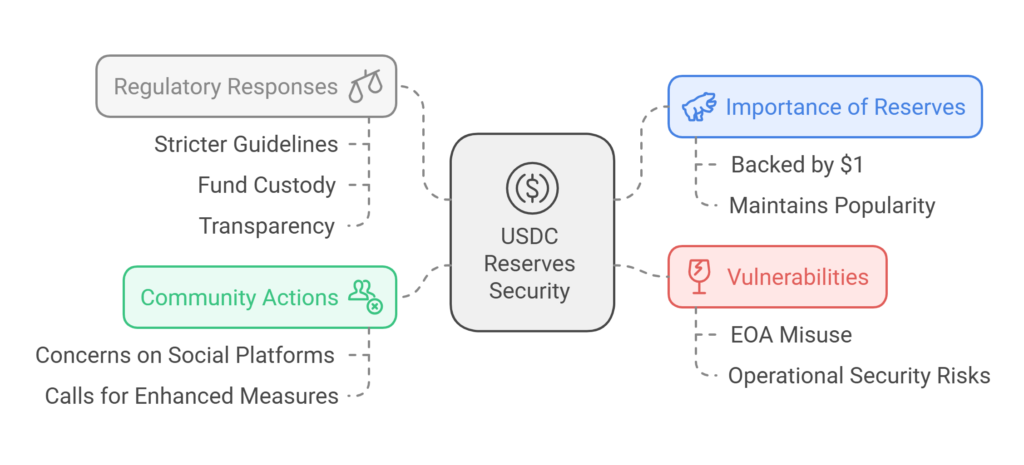

With the growing reliance on stablecoins as a bridge between fiat currencies and cryptocurrencies, USDC reserves security forms the backbone of financial stability in this space. The assurance that each USDC token is backed by $1 in reserves has been crucial in maintaining its popularity and function as a stable digital currency.

A sudden disruption in this stability—caused by vulnerabilities such as EOA misuse—could have immediate and catastrophic effects on associated ecosystems. Developers, investors, and exchanges relying on USDC would be forced to adjust to greater uncertainty, eroding trust in digital dollar substitutes.

Regulatory Scrutiny and Community Response

The rise of questionable practices involving EOAs has likely attracted the attention of regulators and industry leaders. Institutions overseeing stablecoin operations may need to enforce more stringent guidelines around fund custody, transparency, and operational security.

Meanwhile, the crypto community has responded by voicing concerns on social platforms and forums. Many are calling for Circle—the issuer of USDC—and its partners to adopt enhanced measures such as multi-signature wallets, decentralized reserve mechanisms, and real-time audits.

Steps to Bolster USDC Reserves Security and Reduce Risks

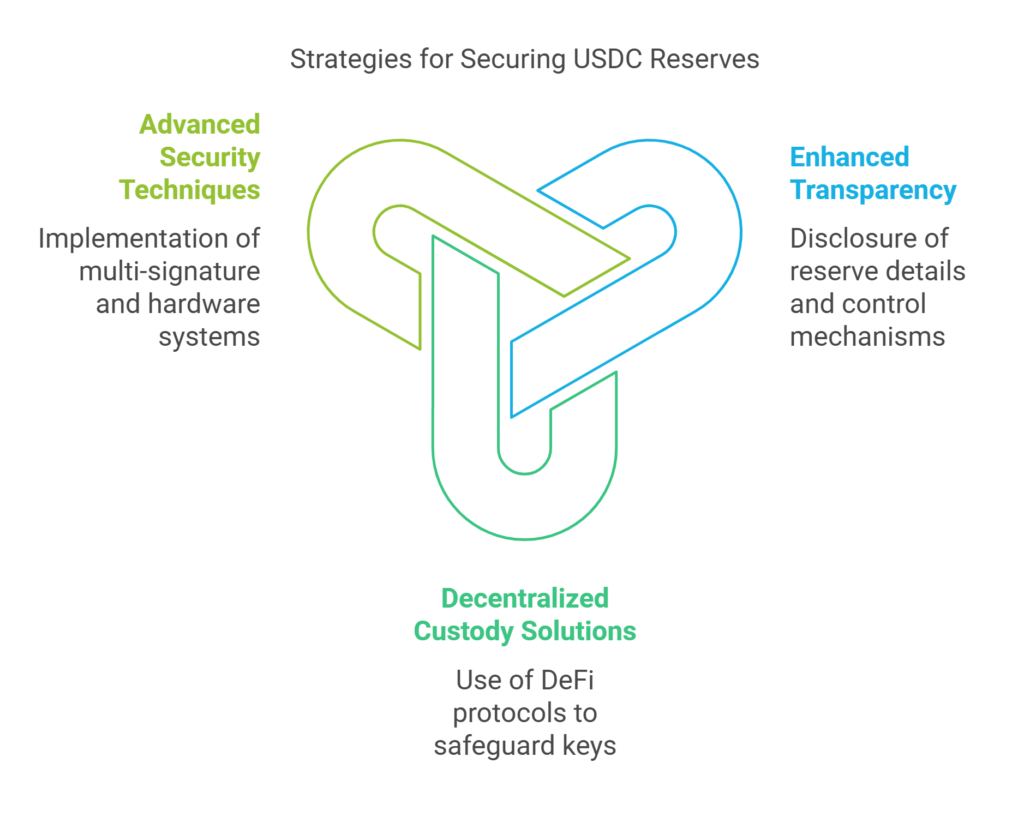

The growing discussion about EOAs emphasizes an urgent need for improved safeguards against potential vulnerabilities. Below are some proactive strategies to mitigate risks:

- Enhanced Transparency: Stablecoin operators must disclose not only reserve details but also active control mechanisms over EOAs. This builds public trust and limits avenues for speculation.

- Decentralized Custody Solutions: Leveraging decentralized finance (DeFi) protocols as a custodian alternative can introduce fail-safes against centralized key misuse.

- Advanced Security Techniques: Multi-signature wallets and hardware-based key management systems provide additional layers of protection against unauthorized access.

By incorporating these techniques and publicly demonstrating improvements, Circle and its affiliated entities could address fears stemming from this $756M EOA usage.

Broader Implications for Stablecoin Ecosystems

The implications of this controversy stretch beyond USDC. As one of the top stablecoins by market capitalization, developments surrounding USDC influence the market perception of alternative tokens like Tether (USDT), Binance USD (BUSD), and others. Any loss of confidence in USDC would ripple through the stablecoin landscape, pressuring other issuers to inform the public of their own security measures.

This ongoing situation demonstrates how collaboration between regulators, developers, and the crypto community can set the stage for a sustainable and secure stablecoin framework.

Key Takeaway: A Precarious Crossroads for USDC and Beyond

While Sky’s use of a $756M EOA has ignited fresh discussion around USDC reserves security, it represents a larger narrative unfolding in the stablecoin market. The need for comprehensive protection of stablecoin reserves is no longer optional—it is imperative. Whether arising from centralized decisions or technical vulnerabilities, threats to reserve integrity have the potential to destabilize global financial systems that have come to depend on cryptocurrencies.

Investors, while navigating these risks, remain hopeful that collaborative industry measures and swift actions will fortify the future of stablecoins.

For more insights and up-to-date crypto news, explore resources and guides at metacandle.net.

“`

Responses