SEC Commissioner Renomination Sparks Fears in Bitcoin ETF Debate

The potential renomination of a Securities and Exchange Commission (SEC) commissioner has sent ripples through the crypto and financial markets, particularly in the ongoing debate regarding a Bitcoin ETF. As the crypto industry continues to advocate for regulatory clarity and the adoption of a Bitcoin exchange-traded fund (ETF), the prospect of certain commissioners holding sway in SEC decisions has caused significant apprehension. This development underlines how regulatory dynamics remain a pivotal force shaping the future of crypto investments.

What’s Behind the SEC Commissioner Renomination?

According to reports from sources like CoinTelegraph, the renomination of SEC commissioner Caroline Crenshaw has sparked concerns within the crypto community. Crenshaw is perceived as being skeptical about cryptocurrency-related products, having consistently raised questions about the risks posed to retail investors in the crypto space. Critics suggest that her continued influence on the Commission could further delay or hinder the approval of Bitcoin ETFs.

Bitcoin ETFs are integral to expanding access to cryptocurrency trading, making it easier for retail and institutional investors to incorporate Bitcoin into their portfolios securely and transparently. Despite strong advocacy from industry leaders and significant progress made in regulatory applications, the SEC has consistently maintained a cautious approach, citing concerns over market manipulation, custody, and investor protection.

The Broader Ramifications of Bitcoin ETF Approval

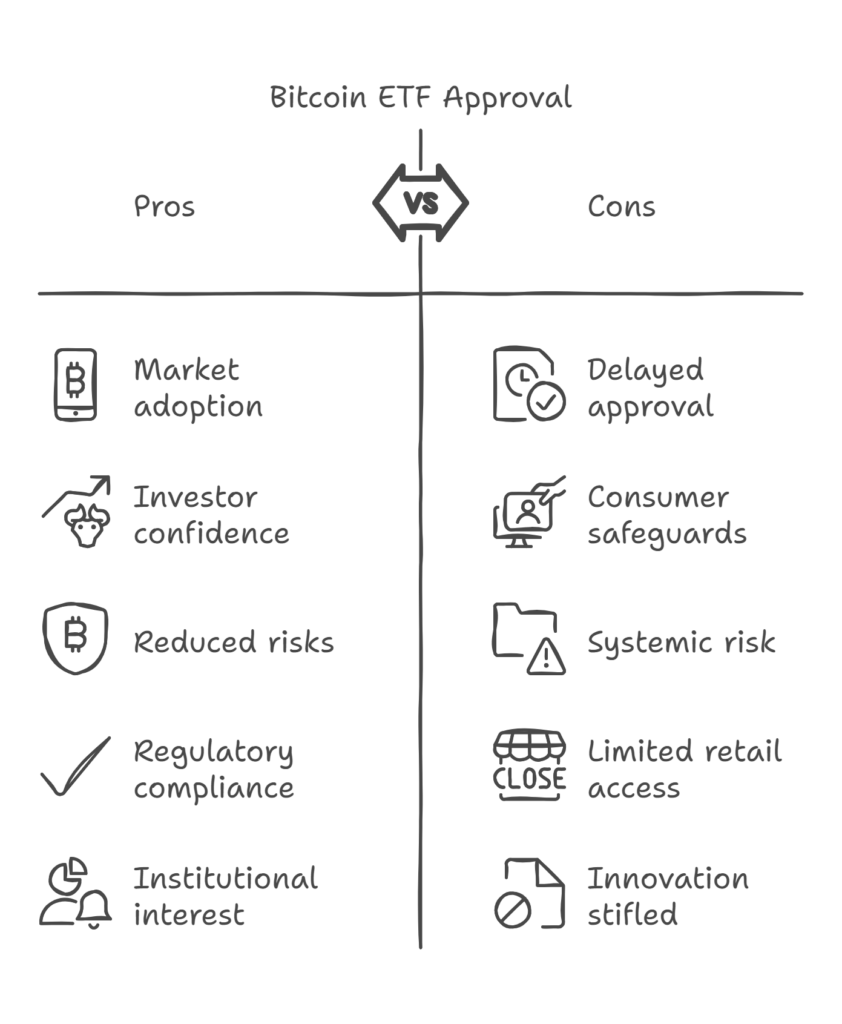

The approval of a Bitcoin ETF is viewed as a crucial step in mainstreaming cryptocurrency investments. ETFs allow investors to gain exposure to Bitcoin without directly purchasing or managing the underlying asset. This not only reduces risks but also simplifies compliance with regulatory standards.

Countries such as Canada and Brazil have already approved Bitcoin ETFs, and their popularity has grown steadily. By contrast, the United States continues to delay such initiatives, with the SEC rejecting multiple applications over the past decade. The reluctance stems from fears about inadequate consumer safeguards and potential systemic risk from unregulated crypto exchanges.

A Bitcoin ETF approval in the U.S. could positively impact crypto prices, boost market adoption, and enhance investor confidence. However, Crenshaw’s renomination and her perceived skepticism toward the crypto industry may signal continued resistance, creating uncertainty for investors and dampening market enthusiasm.

What Could This Mean for Market Participants?

The implications of the SEC’s indecision on a Bitcoin ETF stretch far and wide. Institutional investors, in particular, who typically prefer the regulated nature of ETFs over direct crypto exposure, may hesitate to dive into the crypto market until such an offering becomes available. The delays also stifle innovation in financial products tailored to Bitcoin and other cryptocurrencies.

Retail investors face similar disadvantages. Without access to Bitcoin ETFs, they must rely on less secure platforms for trading cryptocurrencies, which often lack robust consumer protection mechanisms. Additionally, the absence of an ETF prevents the scaling of crypto investments through retirement accounts like IRAs and 401(k)s, limiting broader participation in the market.

Why Does Caroline Crenshaw’s Stance Raise Concerns?

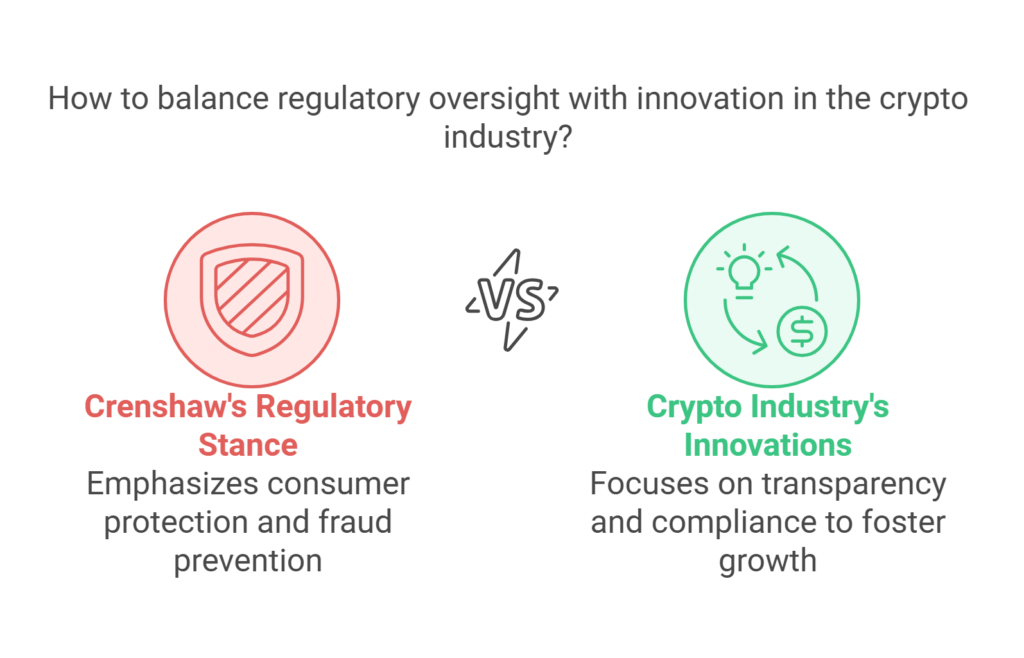

Crenshaw’s reservations about the cryptocurrency space likely stem from broader SEC concerns regarding fraud, manipulation, and transparency on digital asset exchanges. Her public statements have frequently emphasized the need for stronger regulatory frameworks to protect consumers.

For instance, one of the SEC’s repeated justifications for rejecting Bitcoin ETF applications is insufficient evidence that cryptocurrency exchanges can prevent fraudulent activity. Crenshaw’s consistent advocacy for stringent oversight could reflect a broader position within the SEC—a stance many see as incompatible with efforts to realize a fully regulated crypto ecosystem.

While cautious regulatory oversight is essential, critics argue that the SEC’s approach often feels overly conservative, especially as other countries embrace innovation in blockchain-based financial products. Dissenting voices within the crypto sector contend that this hesitancy stifles the U.S.’s potential to lead in a burgeoning global industry.

Steps the Crypto Industry Is Taking to Address Concerns

Despite these challenges, the crypto industry has undertaken efforts to address the SEC’s transparency and security concerns. For instance, companies submitting Bitcoin ETF applications have proposed enhanced custodial solutions, surveillance-sharing agreements with regulated exchanges, and comprehensive investor education initiatives. These measures aim to convince regulators like Crenshaw that the risks associated with Bitcoin ETFs can be mitigated effectively.

In addition, industry leaders are actively engaging with policymakers and regulatory bodies to build trust and foster mutual understanding. This includes developing best practices for compliance, combating illicit activity, and supporting more robust regulatory frameworks that align with investor needs without stifling innovation.

Looking Ahead: What Lies in Store for Bitcoin ETFs?

The renomination of Commissioner Crenshaw underscores the complex relationship between regulators and the rapidly evolving cryptocurrency market. While her potential reappointment might prolong the SEC’s conservative stance, it also presents an opportunity for industry stakeholders to strengthen their dialogue with regulators—ensuring that their concerns are heard and acknowledged.

Market participants should continue to monitor developments closely, as the approval (or rejection) of Bitcoin ETFs will have far-reaching consequences for cryptocurrency adoption and investment. Whether the SEC will overcome its reluctance remains uncertain, but industry advocates remain committed to pushing the conversation forward.

Traders and investors looking to stay informed about the latest in the cryptocurrency space can access in-depth analysis and insights through platforms like MetaCandle.net, which provides updates on regulatory developments, market trends, and investment opportunities.

Conclusion: A Moment of Reckoning for Bitcoin ETFs

The renomination of SEC Commissioner Caroline Crenshaw highlights the ongoing challenges the crypto industry faces in achieving wider mainstream acceptance through tools like Bitcoin ETFs. As the debate unfolds, issues of regulation, transparency, and investor protection will continue to take center stage, shaping the trajectory of the crypto market. For now, the future of Bitcoin ETFs in the U.S. hangs in the balance, but one thing is clear: the evolution of cryptocurrency investment is a story far from over, and its next chapter will be defined by how well the industry and regulators can find common ground.

Responses