Crypto Exchange Compliance: Bitget’s Strategy for Sustainable Growth

The Importance of Crypto Exchange Compliance

Compliance is no longer a secondary concern for crypto exchanges; it is a necessity. Regulatory authorities worldwide, including those in India, are strengthening their oversight of the cryptocurrency market to combat issues such as fraud, money laundering, and tax evasion. This puts significant pressure on platforms to not only ensure that their internal processes meet regulatory standards but also to provide transparency to users.

For Bitget, compliance isn’t just about avoiding legal pitfalls. It represents an opportunity to establish itself as a trusted global platform. The exchange’s approach demonstrates its understanding of both local and international regulations, including those evolving across jurisdictions such as India, Europe, and the United States.

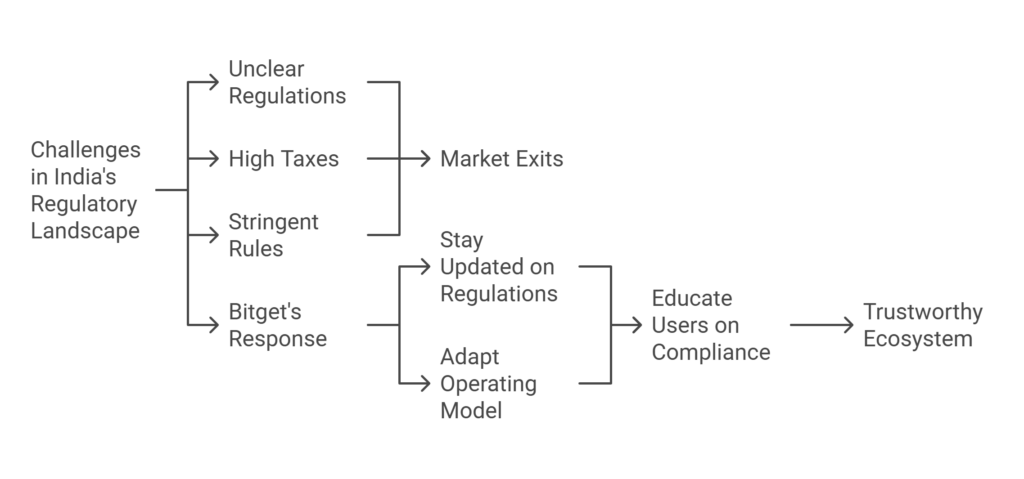

Challenges in India’s Regulatory Landscape

India presents a unique set of challenges for cryptocurrency exchanges. Although the country has a growing user base that actively participates in trading, the lack of clear regulations has created uncertainty. Recently, the Indian government implemented a high tax on crypto transactions and imposed stringent rules that burden both exchanges and traders. This regulatory ambiguity has driven some operators out of the market.

To navigate this, Bitget focuses on staying updated on India’s regulatory shifts and adapting its operating model accordingly. Their strategy aligns with India’s move toward greater transparency while remaining user-centric. For instance, they seek to educate users about how compliance benefits not just exchanges but also individual traders in building a trustworthy ecosystem.

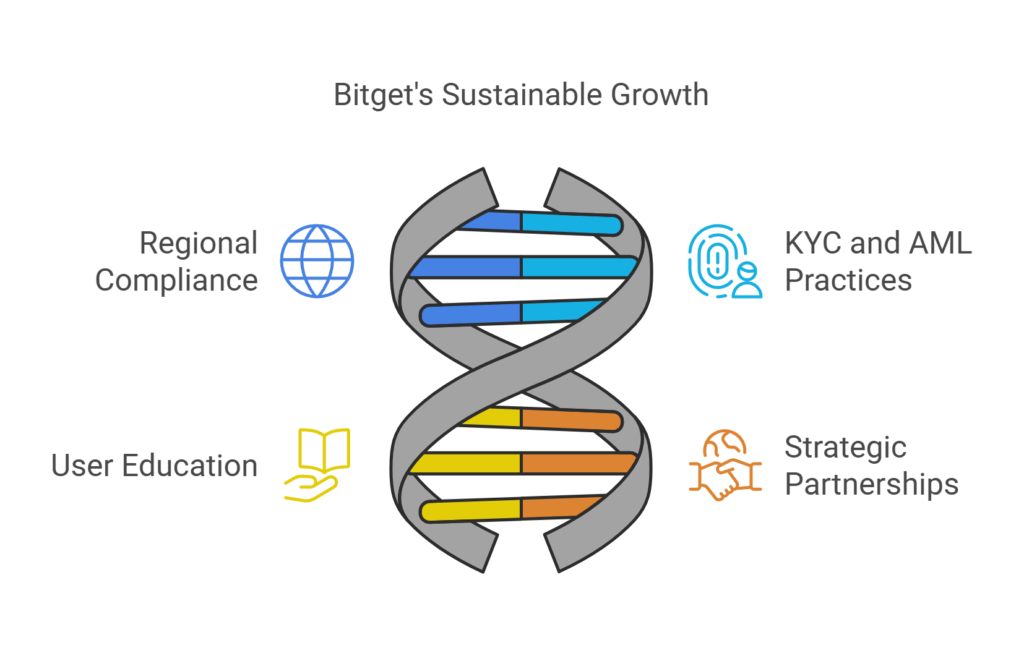

Key Strategies Behind Bitget’s Sustainable Growth

Bitget’s strategy for sustainable growth hinges on adopting a compliance-first approach while continuously innovating to keep up with market dynamics. Below are some key components of their roadmap:

Understanding Regional Regulations

Operating in multiple jurisdictions requires exchanges like Bitget to tailor their compliance practices to the local laws of each region. In addition to understanding the global framework set by organizations such as FATF (Financial Action Task Force), Bitget invests significant resources in deciphering country-specific regulations, including those in emerging nations like India.

Implementing Advanced KYC and AML Practices

Know-Your-Customer (KYC) and Anti-Money Laundering (AML) protocols are now mandatory for most exchanges. On Bitget’s platform, these procedures ensure that all customer accounts are verified while detecting suspicious activities. This is especially critical in markets like India, where regulating authorities demand stringent adherence to such measures.

User Awareness and Education

An often overlooked component of compliance is user education. Bitget focuses heavily on creating resource materials and hosting webinars to help traders understand why regulations matter. For instance, the exchange regularly publishes insights on mitigating risks and ensuring secure transactions. This user-centric approach fosters trust and positions Bitget as a reliable choice amid competing platforms.

Partnerships and Collaboration

Another standout point of Bitget’s strategy is their collaborative approach. Through partnerships with regulatory authorities, financial institutions, and crypto analytic firms, Bitget ensures that it stays ahead of potential compliance issues. These alliances also enable them to design improvements in transparency and customer security.

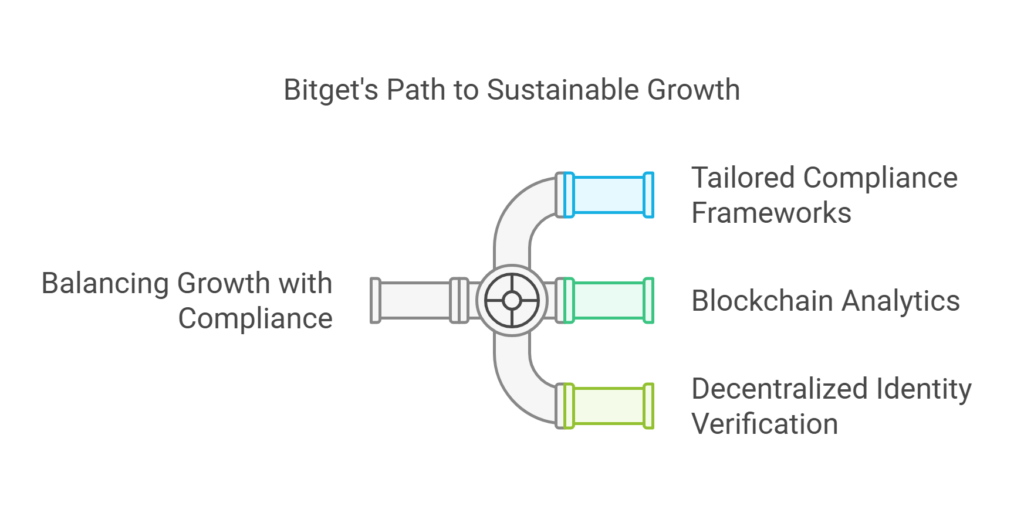

Balancing Growth with Compliance

While strict compliance may seem restrictive for growth, Bitget leverages this as an opportunity for innovation. By implementing tailored compliance frameworks, they optimize operations without creating roadblocks for users. This balance ensures that compliance efforts do not deter growth but rather fuel sustainable expansion.

In addition, Bitget continuously integrates new technologies like blockchain analytics and decentralized identity verification, which facilitate both growth and compliance. These innovations also enhance operational efficiency and reduce costs, allowing the platform to remain competitive amid evolving market dynamics.

The Road Ahead for Crypto Exchanges

The global cryptocurrency landscape is expected to become increasingly regulated in the coming years. Exchanges like Bitget that prioritize compliance will be better positioned to thrive. The anticipated clarity in regulatory frameworks across countries like India, combined with proactive measures undertaken by platforms, is likely to bolster the credibility and appeal of the industry.

Cryptocurrency is often described as the frontier of decentralized finance, but its long-term sustainability depends on integrating robust compliance measures. Bitget’s adaptive approach sets an example for others to emulate as the industry matures further.

For more updates on cryptocurrency trends and exchange strategies, explore Metacandle.net.

Responses