BitOasis Secures Full VASP License to Expand Crypto Trading

The cryptocurrency industry continues to gain momentum, with regulatory frameworks paving the way for more secure and accessible trading opportunities. BitOasis, one of the Middle East’s leading cryptocurrency platforms, recently achieved a significant milestone by securing a full Virtual Asset Service Provider (VASP) license in Dubai. This regulatory approval positions the platform to scale its operations, providing enhanced services to crypto traders and investors across the region.

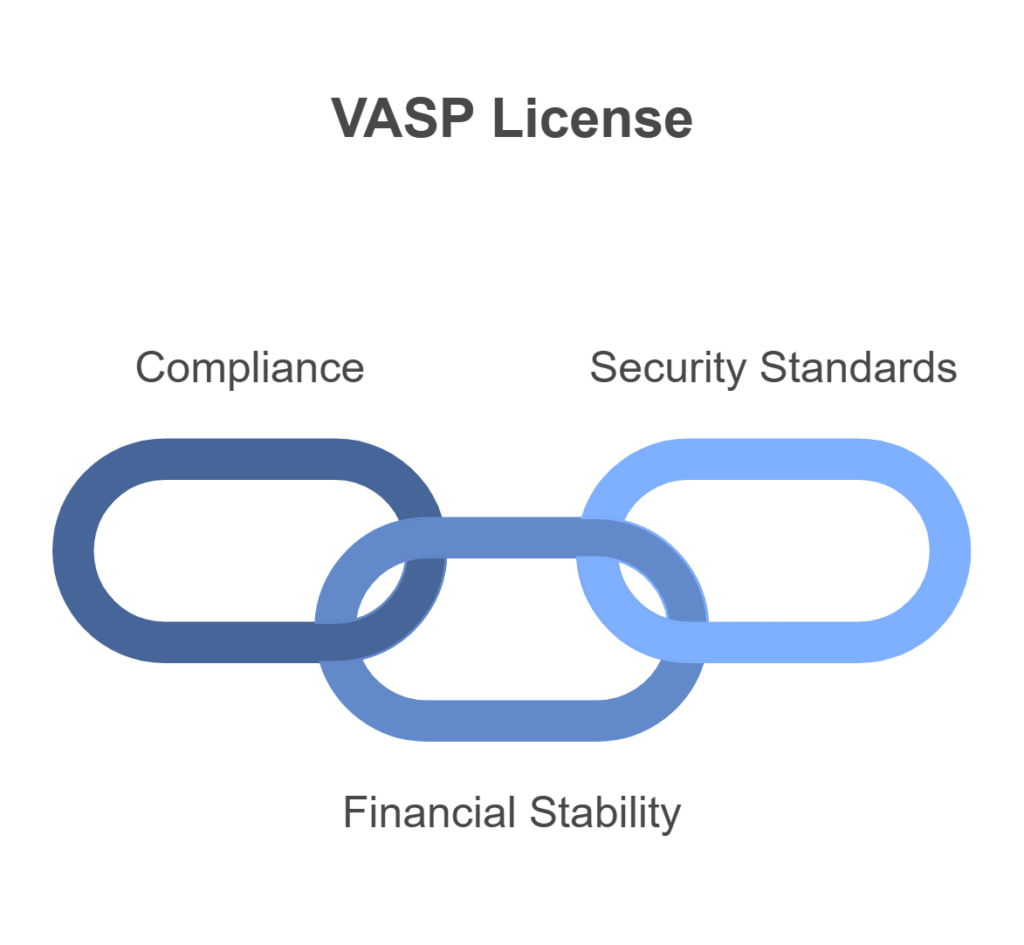

What Does a Full VASP License Mean?

To understand the significance of BitOasis obtaining this license, it’s crucial to unpack what a VASP license entails. Issued by the Dubai Virtual Assets Regulatory Authority (VARA), a VASP license is a certification that allows companies to operate legally within the virtual asset ecosystem. This regulation ensures that platforms adhere to strict compliance, financial stability, and security standards.

By obtaining the full license, BitOasis has demonstrated its commitment to transparency, user protection, and responsible operation in the burgeoning crypto market. This move not only enhances trust amongst its existing users but also strengthens Dubai’s reputation as a global crypto hub.

BitOasis: A Pioneer in the Middle East

As one of the first crypto platforms to be established in the Middle East, BitOasis has consistently been at the forefront of innovation in the region’s digital asset market. The company’s mission is rooted in bridging the gap between traditional finance and modern blockchain technologies, offering a platform for buying, selling, and storing digital assets like Bitcoin, Ethereum, and more.

The Middle East has scaled up its efforts to create a regulatory environment conducive to the growth of the crypto economy. Dubai, in particular, has emerged as a key player by introducing progressive regulations and embracing digital transformation. BitOasis’s success in securing a VASP license underscores the firm’s alignment with Dubai’s vision of becoming a global leader in blockchain technology and digital finance.

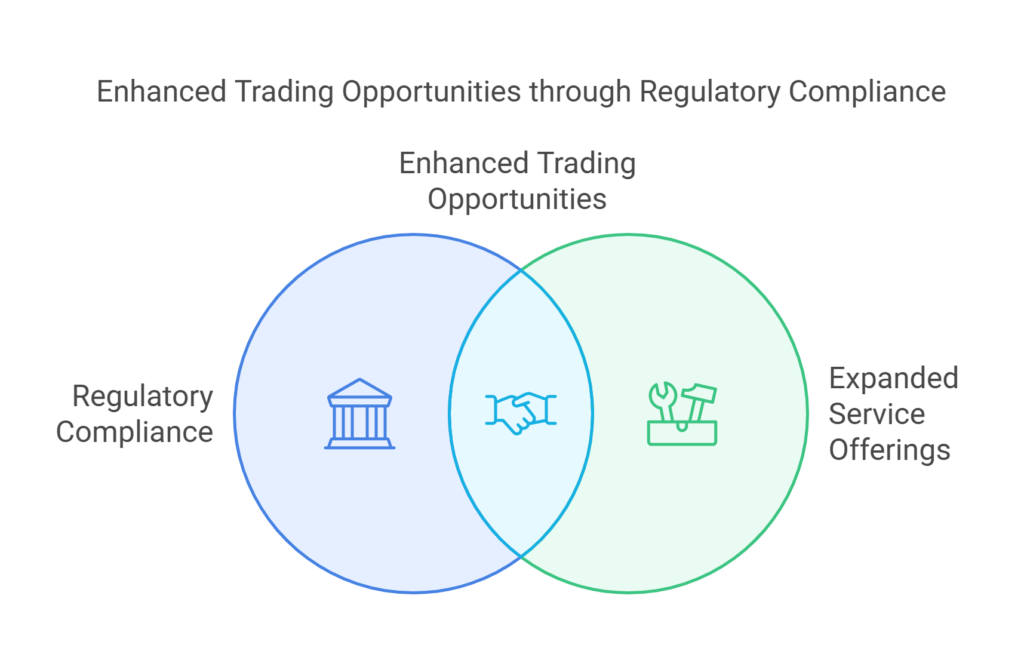

Implications for Crypto Traders and Investors

So, what does BitOasis’s full VASP license mean for the trading community? For starters, enhanced trust and reliability. Regulatory compliance assures traders and investors that the platform follows best practices for safety and security. This development mitigates risks often associated with unregulated exchanges, such as fraud and poor governance.

Moreover, a VASP license enables BitOasis to further expand its service offerings. With the regulatory green light, users can expect a wider array of services, such as advanced trading tools, more supported cryptocurrencies, and potentially decentralized finance (DeFi) opportunities. This expansion of services could cater to both seasoned investors and those just starting their crypto journeys.

For global investors eyeing the Middle East, this development sheds light on the region’s growing maturity in the digital asset space. With Dubai championing blockchain adoption, BitOasis’s achievement serves as an encouraging signal for the future of crypto trading in the region.

What’s Next for BitOasis?

As the crypto market evolves, platforms like BitOasis must stay ahead by innovating and building trust within the ecosystem. Securing a full VASP license is a major step, but it also brings responsibilities. Increased scrutiny and compliance requirements mean that BitOasis must ensure its operational processes remain robust and user-centric.

Looking forward, the platform could leverage its regulatory status to form strategic partnerships, foster institutional trading, and educate the public about cryptocurrency and blockchain technology. Growth could also come from collaborations with global crypto firms aiming to establish a foothold in the Middle East, further boosting liquidity and ecosystem development.

Dubai’s Role in Shaping the Crypto Landscape

Dubai’s regulatory advancements in the crypto space are undoubtedly a core driver of BitOasis’s success. Through VARA, the city has established itself as one of the most forward-thinking jurisdictions for cryptocurrency and blockchain adoption. According to reports, VARA provides clear guidelines for digital asset activities, creating an environment of transparency for both companies and users.

Notably, Dubai is not just a regulatory leader — it has also invested heavily in blockchain innovation across multiple industries, from real estate to logistics. This proactive stance ensures the city remains an attractive destination for blockchain startups and established firms alike. BitOasis’s newfound status aligns with Dubai’s overarching goal: to be a global hub for blockchain innovation.

For those interested in how investor-friendly regulations are shaping financial markets, platforms like MetaCandle provide expert insights, news, and analysis tailored to help traders make informed decisions.

Challenges and Opportunities Ahead

While the full VASP license is a major win, the road ahead is not without challenges for BitOasis. The crypto industry remains highly volatile, with rapid changes in regulatory landscapes and market conditions. Moreover, as competition increases, maintaining a loyal user base will require constant innovation and exceptional customer service.

However, the opportunities for growth are enormous. With the regulatory stamp of approval, BitOasis is now positioned to capture more market share and attract institutional clients. The rising adoption of cryptocurrencies globally also suggests a growing user base for platforms that offer secure and reliable trading experiences.

Conclusion

BitOasis’s acquisition of a full Virtual Asset Service Provider license is a landmark achievement, not only for the platform but for the Middle East’s entire crypto ecosystem. This regulatory milestone signifies trust, compliance, and strategic alignment with Dubai’s ambitions as a leader in blockchain and digital finance. It also offers a promising future for crypto traders and investors, who can now engage with the platform in a safer and more robust environment.

As the crypto landscape continues to evolve, BitOasis’s journey highlights the importance of regulatory clarity in fostering growth and innovation. By securing its position as a licensed VASP, BitOasis is enabling the next phase of crypto trading in the region, solidifying its role as the go-to platform for digital asset management.

Responses