Bitcoin Warning: Be Prepared When the Music Stops

Why Bitcoin Long-Term Holders May Signal Market Warnings

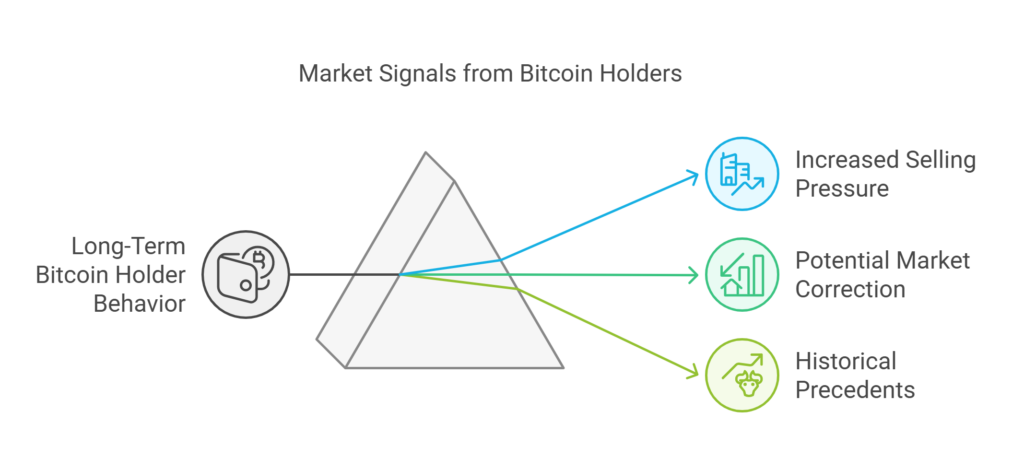

Recent market data suggests long-term Bitcoin holders are cashing in on substantial gains, potentially indicating a local or cyclical market top. According to leading crypto analysts, large monthly sales from wallets that have been dormant for years are a red flag for heightened selling pressure. Historically, when long-term holders begin to offload their positions, it often signals an upcoming correction or increased volatility.

For context, many long-term holders accumulated Bitcoin during its earlier, much lower price points. As Bitcoin approaches key psychological barriers, such as $30,000 or $40,000, this “profit-taking event” becomes a natural market behavior. The trend echoes similar situations in previous bull runs, such as the peaks of 2013, 2017, and 2021 when large capitulations by veterans preceded prolonged bear cycles.

Analyzing On-Chain Metrics for Telltale Signs

On-chain data — which tracks transactions occurring directly within the blockchain — is an indispensable way to assess market sentiment and long-term holder activity. Metrics like Spent Output Profit Ratio (SOPR) show whether investors are selling their Bitcoin at a profit or a loss. Recent SOPR readings suggest Bitcoin’s current rally may be supported largely by profit-driven selling rather than fresh inflows of capital.

Another key metric is the market capitalization to realized value ratio (MVRV), which helps identify overvaluation or undervaluation zones. Current MVRV rates suggest that Bitcoin might be entering the overbought territory — a warning sign for imminent pullbacks.

Macroeconomic Ripple Effects on Bitcoin

In addition to on-chain signals, macroeconomic conditions also play a significant role in Bitcoin’s price trajectory. The cryptocurrency market remains tightly intertwined with global financial markets, responding to Federal Reserve policies, inflation data, and geopolitical developments. For instance, the tightening of monetary policy has historically reduced liquidity in risk-on assets, including Bitcoin.

Looking at 2023 and beyond, shifts in investor confidence due to rising regulatory actions or potential ETF approvals could create sudden shifts in Bitcoin’s momentum. Long-term holders selling during such moments only adds fuel to the fire.

The Role of Market Sentiment in Bitcoin’s Future

Market sentiment is a key driver of Bitcoin’s price. Tools like the Fear and Greed Index often show extreme movements in sentiment, especially during major price rallies or crashes. An overwhelming amount of greed often correlates with market tops, as euphoria leads traders to buy in at inflated prices.

Currently, sentiment scores appear to be leaning into “greed” territory, as the recent Bitcoin rally has inspired confidence in retail investors. This euphoria could be short-lived if larger, seasoned players begin liquidating their positions on exchanges. As the saying goes: “When the crowd zigs, the pros zag.”

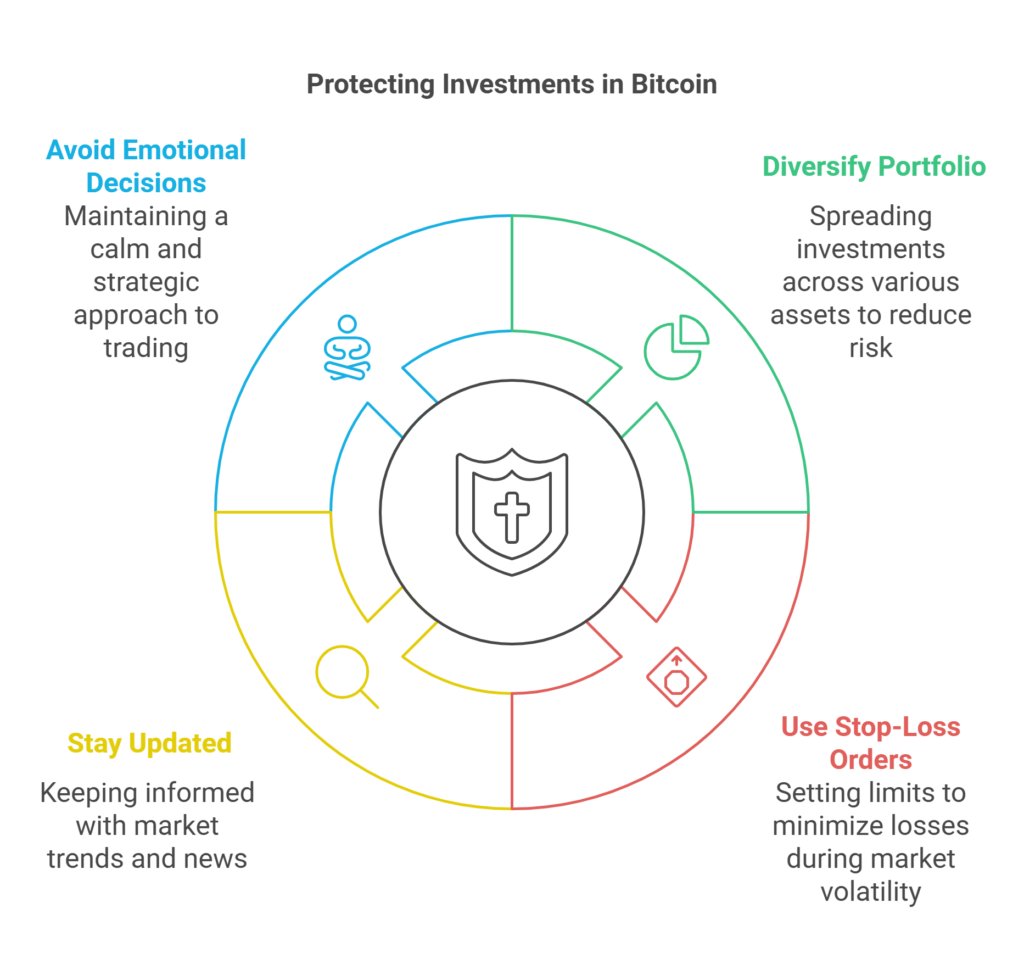

How to Protect Yourself Before the Music Stops

While uncertainty looms, you don’t have to sit idle. Here are actionable steps traders and investors can take to navigate potential Bitcoin corrections:

1. Diversify Your Portfolio

Diversification remains a fundamental principle of investment. In times of Bitcoin volatility, consider allocating assets to a mix of stocks, bonds, commodities, or alternative cryptocurrencies. Diversification helps spread risk and reduces dependence on any single asset class.

2. Use Stop-Loss Orders

Stop-loss orders are essential trading tools, especially in a volatile market like crypto. Setting a stop-loss at a reasonable percentage below your entry price ensures you lock in gains or minimize losses during unexpected price reversals.

3. Stay Updated on Market Trends

Knowledge is power in the fast-moving cryptocurrency world. Websites like MetaCandle.net provide timely news, market analysis, and insights to keep you informed. Regularly checking reliable sources ensures you’re prepared for sudden price movements or market developments.

4. Avoid Emotional Decisions

One of the biggest mistakes traders make during corrections is panic-selling. Emotional decisions often lead to selling at the bottom or exiting too early before the next rally. Having a predefined investment plan can help you stick to your strategy no matter the turbulence.

Bitcoin Price Correction: When, Not If

Although no one can predict the exact timing or magnitude of a Bitcoin correction, history has shown us that “what goes up must come down.” Staying vigilant and prepared for the music to stop is paramount to preserving your gains. Long-term holders, on-chain analysis, and market sentiment on their own can’t dictate the future, but combined, they offer a clearer picture of risks ahead.

In conclusion, this Bitcoin warning is a reminder for traders and investors to assess their current positions honestly and consider any potential downside risk. The recent activity of long-term holders and broader macroeconomic challenges signal that turbulence may be on the horizon. Whether you’re a seasoned veteran or a newcomer to the crypto world, staying informed, diversified, and strategic is the key to navigating this unpredictable market.

Responses