Bitcoin Price Stagnates in Low Liquidity 7-Day Trading Range

The Bitcoin price has remained stagnant over the past week, trading within a narrow range under conditions of low liquidity. This lack of movement leaves traders and investors questioning the cryptocurrency’s next move, especially as broader market dynamics continue to shift. In this article, we’ll explore the key factors contributing to Bitcoin’s current price stability and what this means for the market moving forward.

Key Drivers Behind Bitcoin Price Stagnates

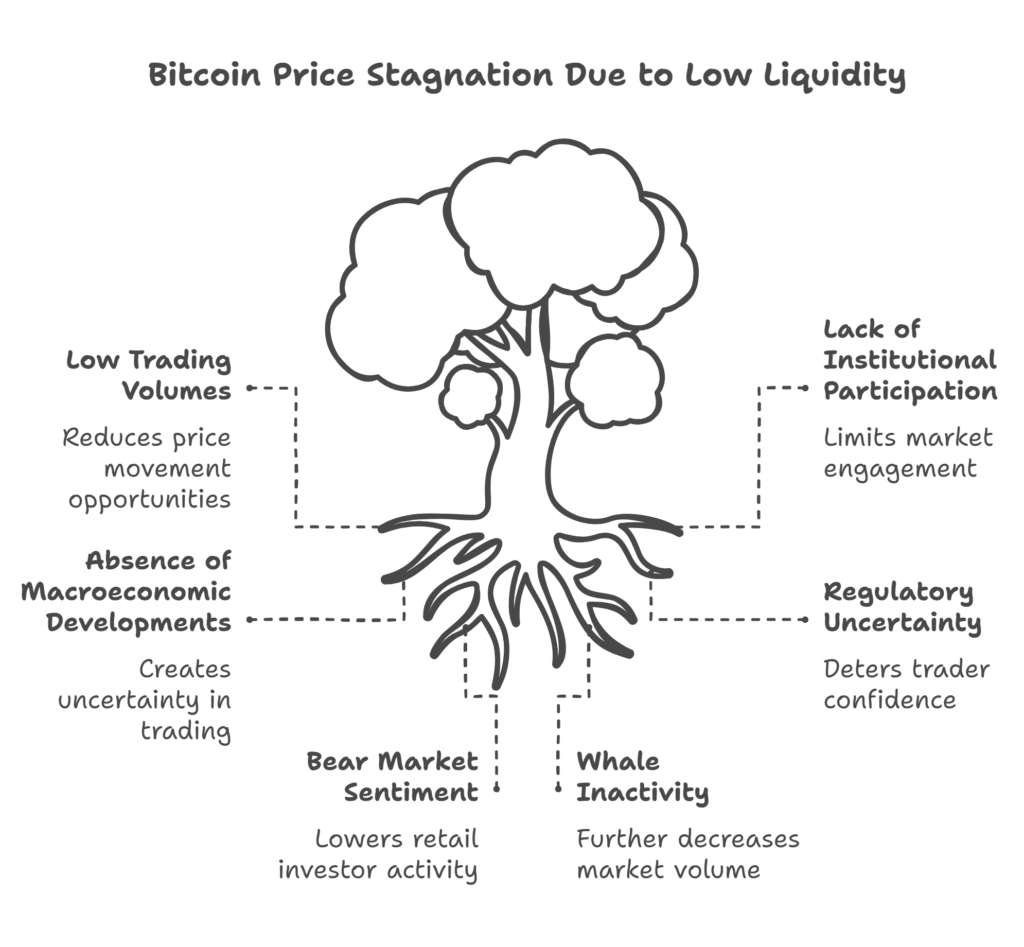

Bitcoin’s recent inability to break out of its low liquidity 7-day trading range stems from a combination of market factors. Low trading volumes, a lack of institutional participation, and the absence of new, defining macroeconomic developments all contribute to this stagnant market behavior.

Low liquidity directly affects price movement. When fewer market participants engage in trading, particularly on major exchanges, price volatility decreases. While a calm market might initially seem positive, prolonged inaction often breeds frustration among day traders and retail investors. Similarly, whales—large entities or individual investors holding significant amounts of Bitcoin—are refraining from making significant moves, which reduces volume further.

In addition, events such as pauses or indecisions by major central banks on interest rates, as well as general uncertainty in the financial markets, influence Bitcoin volatility. With traders waiting for clear macroeconomic signals, the cryptocurrency market continues to hover in its current narrow range.

Understanding Low Liquidity’s Role in Bitcoin Price Dynamics

Liquidity, or the ability of an asset to be quickly converted into cash without affecting its price, plays a crucial role in determining Bitcoin’s trading behavior. When liquidity is high, markets are more efficient, and price movements tend to be more stable and predictable. However, when liquidity dries up, even small trades can lead to outsized price fluctuations—or, conversely, an extended period of stagnation.

Currently, Bitcoin’s low liquidity is a reflection of broader market sentiment. Many traders have moved to the sidelines amid uncertainty related to regulatory actions and economic policies. Furthermore, the bear market conditions of 2022 and early 2023 have left some retail investors skeptical, leading to diminished market participation.

Nonetheless, seasoned investors often view periods of low liquidity and rangebound price action as an opportunity to accumulate Bitcoin. These phases frequently precede significant price movements, though predicting the direction and timing of the next breakout remains extremely challenging.

Historical Perspective: Bitcoin’s Previous Periods of Stagnation

To understand the current scenario better, we can look at similar phases in Bitcoin’s history. Periods of consolidation and tight range trading are not uncommon for this cryptocurrency. For instance, in 2018, Bitcoin traded sideways for months before plunging below $4,000. On the flip side, periods of consolidation have also acted as a precursor to substantial bullish runs, such as the surge from $10,000 to $60,000 between late 2020 and early 2021.

The key takeaway is that Bitcoin’s prolonged periods of inactivity often represent a tipping point. Market participants closely monitor these phases, knowing that a breakout could result in significant gains—or losses.

Market Sentiment: What Are Traders Saying?

Traders and analysts have mixed opinions about Bitcoin’s current price behavior. Some believe the market is waiting for a strong catalyst, such as regulatory clarity or macroeconomic developments like interest rate decisions and inflation data. Others argue that Bitcoin may simply need more time to recover investor confidence after the bearish trends that dominated the past year.

One influential factor shaping sentiment is Bitcoin’s correlation with traditional financial markets. Despite being traditionally viewed as a hedge against inflation, Bitcoin’s price has been moving in tandem with risk-on assets like equities in recent months. As such, any developments in the stock market or changes in economic policies are likely to influence Bitcoin’s trajectory as well.

What to Watch For: Indicators of the Next Big Move

While no one can predict Bitcoin’s price with certainty, there are several indicators that traders and investors watch closely to gauge the potential for a breakout:

- Volume surges: A sudden spike in trading volume often indicates renewed interest in Bitcoin and a potential move out of the consolidation zone.

- Regulatory news: Developments surrounding cryptocurrency regulations can dramatically impact market sentiment and prices.

- Macroeconomic factors: Interest rate changes, inflation news, and general economic stability are critical factors affecting Bitcoin’s price.

- Whale activity: Monitoring the buying and selling patterns of large Bitcoin holders can provide insights into the market’s next steps.

Should Investors Be Concerned About the Stagnation?

Periods of stagnation are neither inherently good nor bad; much depends on an investor’s goals, risk tolerance, and market strategy. For long-term holders, the current range could be an opportunity to accumulate Bitcoin at what may be seen as future discounted prices. For traders, however, the absence of volatility presents fewer profit opportunities.

Moreover, prolonged periods of inactivity can erode trader interest, potentially leading to even lower liquidity. If this happens, the likelihood of sharp price swings—either upwards or downwards—intensifies.

How to Stay Updated on Market Trends

Given Bitcoin’s price stagnation and the overall market’s low liquidity, staying informed about ongoing trends is essential for both new and experienced investors. Platforms like Metacandle.net provide valuable insights to help traders track key metrics and understand market dynamics more effectively.

Conclusion: A Waiting Game for Bitcoin

Bitcoin’s price stagnation in its 7-day trading range is a reflection of current market conditions, characterized by low liquidity, cautious sentiment, and economic uncertainty. While this phase may test the patience of traders, it also presents a potential opportunity for strategic investors to position themselves for the next big move.

As always, market participants should exercise caution and conduct thorough research before making any investment decisions. Whether Bitcoin breaks out to the upside or downside, one thing remains certain: this phase of stagnation is unlikely to last forever.

Responses