Bitcoin Hits $100K Milestone in Historic Crypto Surge

What Led to Bitcoin’s $100K Milestone?

Bitcoin’s impressive rise to $100K comes on the heels of several intertwined factors. Market dynamics, macroeconomic trends, and growing adoption have all played significant roles in driving the price to this historic level.

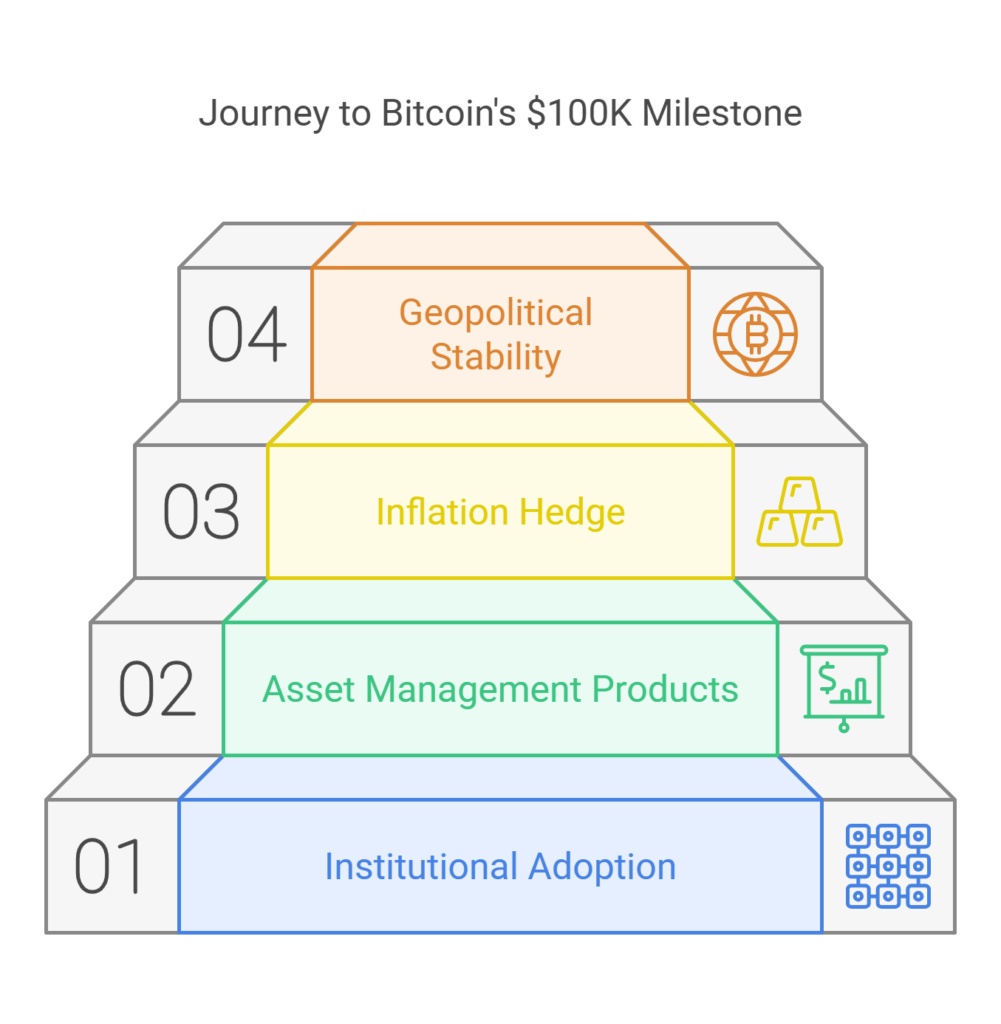

Institutional Adoption Continues to Rise

One of the leading catalysts behind Bitcoin’s surge has been the ever-growing appetite from institutional investors. Over the last few years, major corporations and financial institutions have entered the crypto space. Companies like Tesla, MicroStrategy, and Square have added Bitcoin to their balance sheets, while asset management giants like BlackRock have launched Bitcoin-related investment products.

This influx of institutional capital has not only fueled demand but also lent credibility to the asset in the eyes of skeptics. Many analysts believe the $100K milestone is a direct result of this institutional confidence.

Macroeconomic Factors Driving Demand

Macroeconomic trends have also boosted Bitcoin’s appeal. Rising inflation, volatile fiat currencies, and central banks’ dovish monetary policies have pushed investors to seek alternatives to traditional financial systems. Bitcoin, often referred to as “digital gold,” has become a hedge against inflation for many.

Moreover, geopolitical tensions and economic instability in regions such as Latin America and Eastern Europe have also increased Bitcoin adoption as a means of preserving wealth and facilitating cross-border transactions.

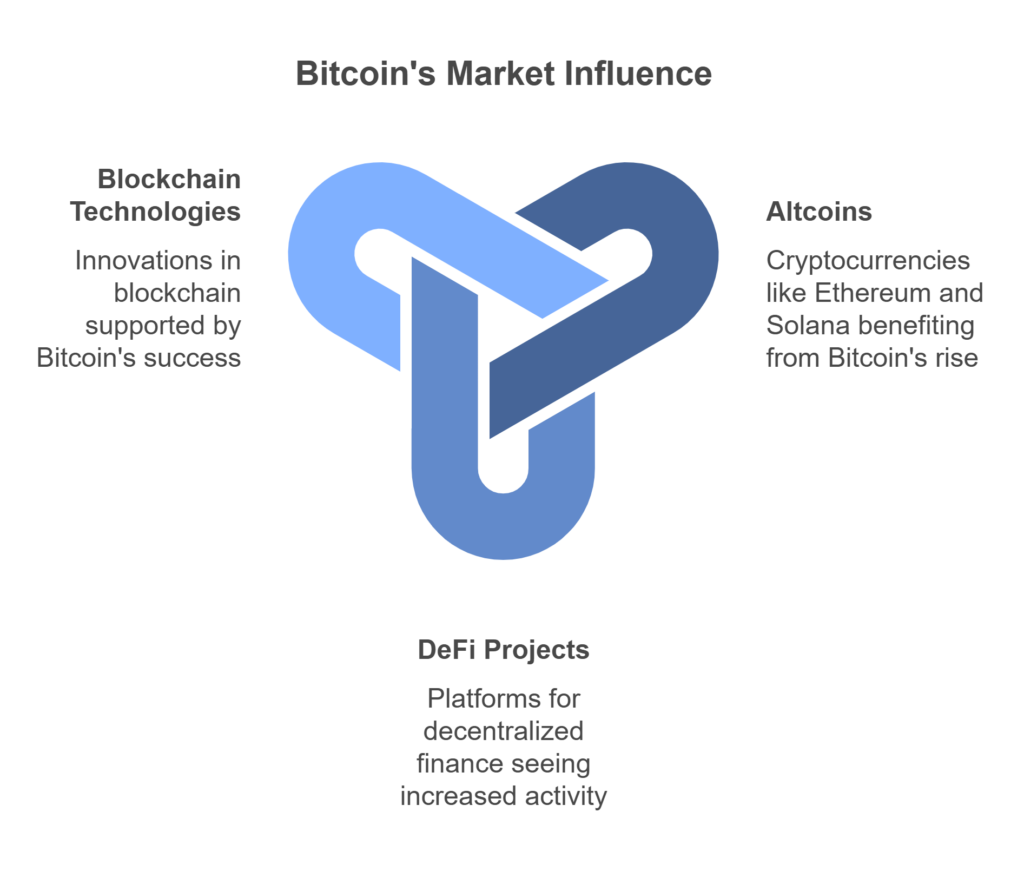

Impact on the Crypto Market

Bitcoin’s $100K milestone is not just significant for BTC holders but has profound implications for the entire cryptocurrency market. Altcoins, decentralized finance (DeFi) projects, and blockchain technologies stand to benefit from this new wave of attention. Historically, Bitcoin price surges have acted as a catalyst for broader market rallies, a phenomenon commonly referred to as “alt season.”

Ripple Effects on Altcoins

As Bitcoin tops $100K, many traders are now eyeing altcoins like Ethereum, Solana, and Cardano. Historically, altcoins tend to follow Bitcoin’s price movements, albeit with higher volatility. Ethereum, for instance, is benefiting from the rise in decentralized applications (dApps) and the continued adoption of Layer-2 solutions.

Additionally, projects tied to innovations like non-fungible tokens (NFTs) and the metaverse have also experienced renewed investor interest. These developments highlight the increasingly diverse ecosystem that blockchain technology supports.

DeFi and NFT Markets See a Boost

The rise of Bitcoin has also sparked renewed activity in both the DeFi and NFT spaces. Platforms offering decentralized lending, borrowing, and staking are seeing surges in total value locked (TVL), while NFT marketplaces continue to thrive with growing mainstream interest.

This upward momentum underscores the interconnected nature of the cryptocurrency market, where Bitcoin often acts as the gateway asset for new investors exploring the world of blockchain innovation.

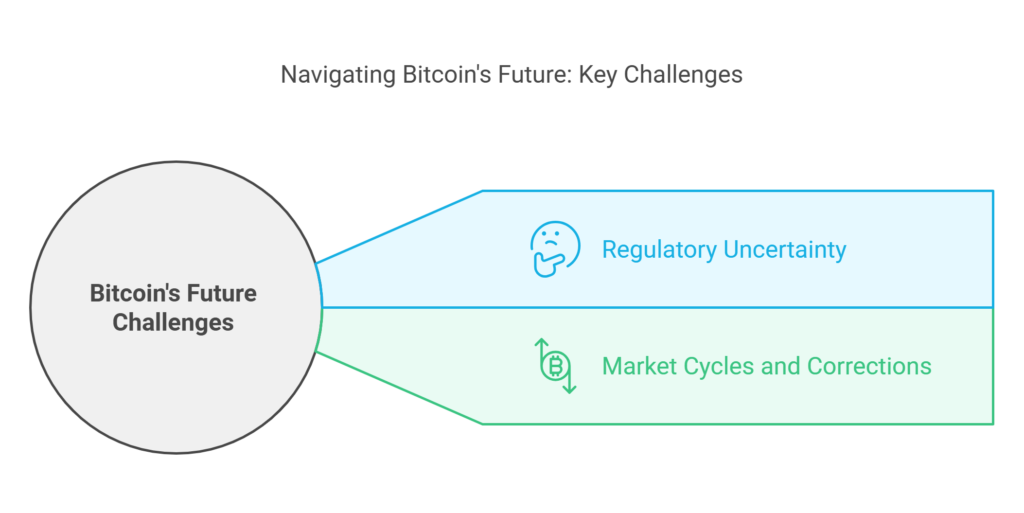

Challenges and Risks Ahead

While reaching $100K is a monumental achievement, Bitcoin’s journey is far from over. As with any speculative asset, potential risks and volatility remain key concerns for investors and analysts.

Regulatory Uncertainty

Regulation continues to be a major unknown for the cryptocurrency market. Governments worldwide are grappling with how to regulate Bitcoin without stifling innovation. While some countries, like El Salvador, have embraced Bitcoin as legal tender, others, like China, continue to crack down on crypto-related activities.

Potential future regulation from major economies, especially the United States and the European Union, could impact Bitcoin’s price trajectory in either direction.

Market Cycles and Corrections

Bitcoin’s history has been punctuated by extreme bull and bear markets. While the current sentiment is incredibly positive, past cycles remind us that corrections are an inherent part of the process. Investors must remain mindful of the potential for short-term price volatility even as Bitcoin marches toward longer-term adoption.

What’s Next for Bitcoin?

Having crossed the $100K threshold, many are now speculating about Bitcoin’s next move. Some optimistic projections from industry leaders suggest that Bitcoin could reach $250K or even $500K in the coming years, driven by continued retail and institutional adoption, halving events, and technological advancements.

However, others urge caution, emphasizing the need for consolidation above $100K before the market can sustain further gains. Much will depend on how the factors outlined above—regulation, macroeconomics, and market cycles—unfold in the near future.

Conclusion: A Historic Day for Bitcoin

Bitcoin hitting $100K is a landmark moment in the history of financial markets. It signifies not only the maturation of the cryptocurrency market but also the growing acceptance of Bitcoin as a legitimate asset class. For traders and investors, this historic crypto surge offers both opportunities and challenges in navigating the evolving landscape.

Whether you’re a seasoned market participant or someone new to the space, staying informed is crucial. For more news, insights, and analysis about the financial markets, visit MetaCandle.net.

Responses