Bitcoin Flash Crash Below 93K Sparks Crypto Market Volatility

What Triggered the Bitcoin Flash Crash Below $93K?

The sudden drop in Bitcoin’s price was reportedly caused by a combination of factors, including a surge in sell orders and macroeconomic developments. Market sentiment shifted drastically following bearish indicators, leaving many traders unprepared for the sudden downturn. Though Bitcoin is no stranger to volatile price swings, this flash crash has reignited concerns about the maturity and stability of the cryptocurrency market.

Analysts suggest that liquidity issues on major exchanges may have exacerbated the situation. During periods of intense market activity, thin order books and imbalanced buy-sell demands can amplify price declines. Moreover, concerns about regulatory crackdowns in significant markets like the United States and Europe added to investor panic.

Impact of External Economic Factors on Bitcoin and Crypto Markets

Beyond internal pressures within the crypto market, external economic factors played a role in Bitcoin’s flash crash. Global inflation concerns and tighter monetary policies from central banks have left risk-on assets, including cryptocurrencies, under significant pressure.

For instance, rising interest rates have made traditional investments like bonds and savings more attractive to risk-averse investors. As a result, speculative assets like Bitcoin and altcoins are experiencing reduced demand. According to IMF reports, macroeconomic instability deters investors from holding volatile assets, further contributing to a sell-off environment.

Broader Crypto Market Turmoil

The Bitcoin flash crash had ripple effects across the broader cryptocurrency market. Major altcoins like Ethereum, Binance Coin, and XRP also lost significant value in a short period. Solana (SOL) and Cardano (ADA) were among the hardest-hit digital assets during the market turmoil. The total market capitalization of cryptocurrency saw billions wiped out within hours, showcasing the interconnected nature of the ecosystem.

This volatility has reinforced the importance of diversification. According to crypto trading experts, balancing a portfolio with stablecoins and less-correlated assets can reduce the impact of sudden market fluctuations. For active traders and HODLers alike, the abrupt dip serves as a reminder to exercise caution, even during bullish trends.

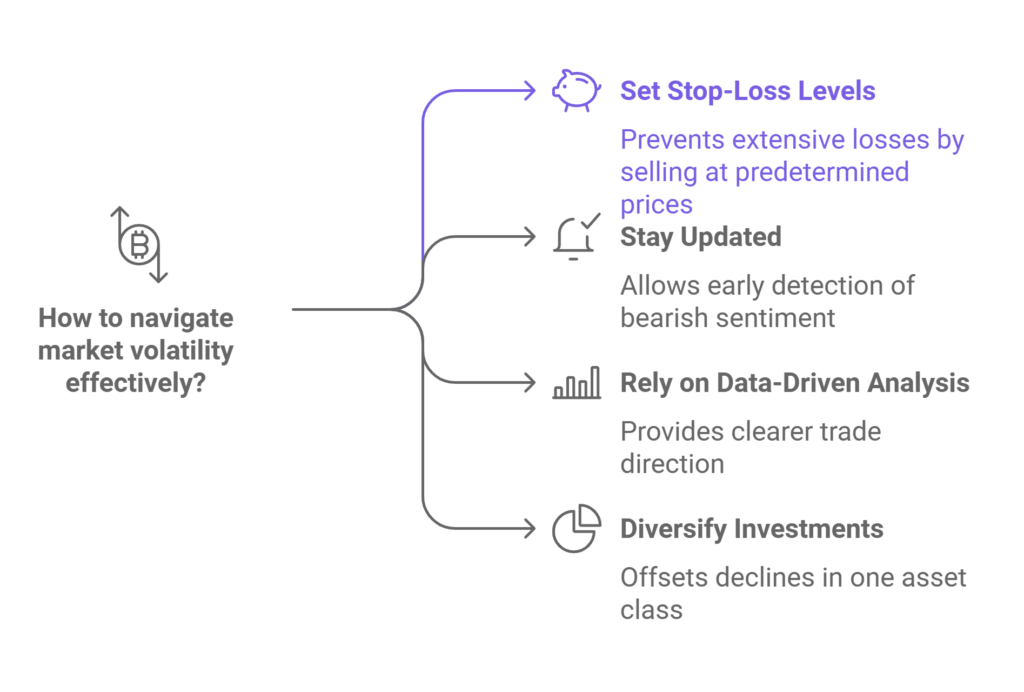

How to Navigate Market Volatility?

Events like this Bitcoin flash crash highlight the necessity of proactive trading strategies and risk management. Here are a few tips that traders can implement to safeguard their investments:

- Set Stop-Loss Levels: Employing stop-loss orders can automatically sell your holdings once the price drops to a predetermined level, preventing extensive losses.

- Stay Updated: Constantly monitor news and market trends to spot the emergence of bearish sentiment early.

- Rely on Data-Driven Analysis: Leveraging technical analysis and sentiment indicators can provide a clearer direction for your trades.

- Diversify Investments: Spread your holdings across various cryptos to offset declines in one asset class.

More resources on managing crypto market volatility can also be found at Metacandle.net, a hub for traders looking to refine their strategies.

Regulatory Fears Adding to the Panic

Another key factor contributing to the Bitcoin flash crash below $93K is mounting regulatory scrutiny. Governments across the globe are intensifying their focus on the crypto sector, citing concerns over money laundering, tax evasion, and financial stability. For example, ongoing debates around stablecoin legislation and classification of cryptocurrencies as securities have caused some institutional investors to tread carefully.

While these regulations aim to make the market safer, their ambiguity can lead to sudden investor pullbacks, compounding existing volatility. To mitigate these risks, regulatory clarity is crucial for restoring confidence in the market.

Bitcoin’s Historical Flash Crashes: Lessons to Remember

Bitcoin’s journey has been punctuated by numerous flash crashes over the years. The most notable ones include the corrections following the 2017 bull run and the “Black Thursday” crash in March 2020. These events reflected how external triggers, such as exchange outages or broader economic crises, can lead to cascading sell-offs in the crypto market.

One consistent takeaway from these incidents is the market’s resiliency. Despite steep declines, Bitcoin and other cryptocurrencies have showcased a remarkable ability to recover over time. The durability of blockchain technology combined with evolving use cases ensures a bright future for enthusiasts who believe in the long-term value of digital assets.

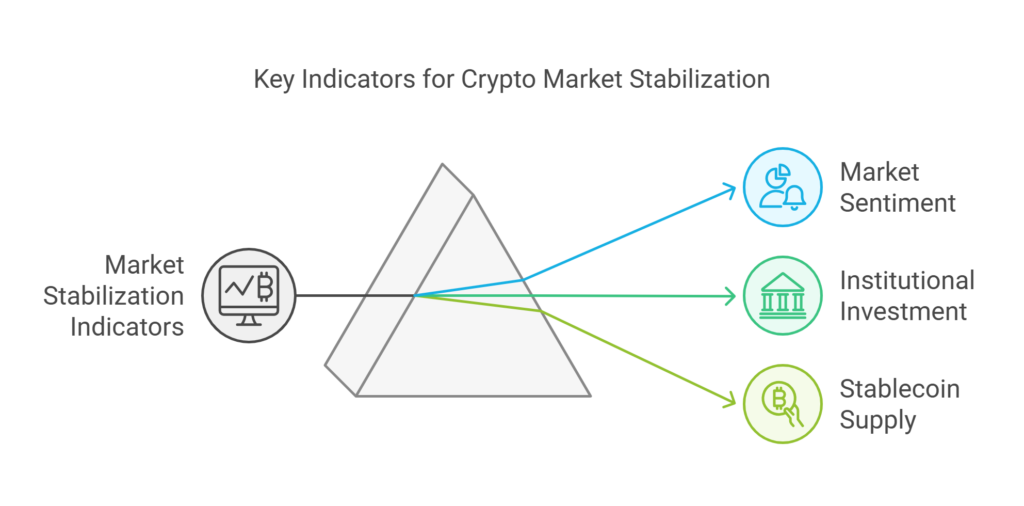

When Will the Market Stabilize?

Predicting when Bitcoin and the broader crypto market will stabilize is no easy task. For now, key indicators to watch include:

- Market Sentiment: Fear and Greed Index trends can offer good insights into how investors view the current market conditions.

- Institutional Investment: Signs of large institutions entering or exiting positions are pivotal for sustaining price momentum.

- Stablecoin Supply: An increase in stablecoin inflows to exchanges might indicate readiness for additional buying activity.

While the short-term remains uncertain, analysts continue to recommend maintaining a balanced perspective. Potential future use cases for Bitcoin, such as its adoption as a legal tender, could serve as a silver lining for long-term investors.

Final Thoughts: Navigating the Aftermath of Volatility

The Bitcoin flash crash below $93K has reignited discussion around crypto market volatility—and for good reason. As the market evolves, it is vital for participants to remain vigilant and informed. While flash crashes may be unsettling, they shouldn’t overshadow the broader technological advancements and adoption trends that support Bitcoin and other digital assets.

For those still keen to explore opportunities in crypto trading, resources like Metacandle.net can provide valuable insights and tools. As always, strategic investing combined with a thorough understanding of the market will be the key to navigating these unpredictable times.

Responses