Bitcoin Hits $100K Boosting El Salvador’s $300M Profit

El Salvador’s Journey to Bitcoin Adoption

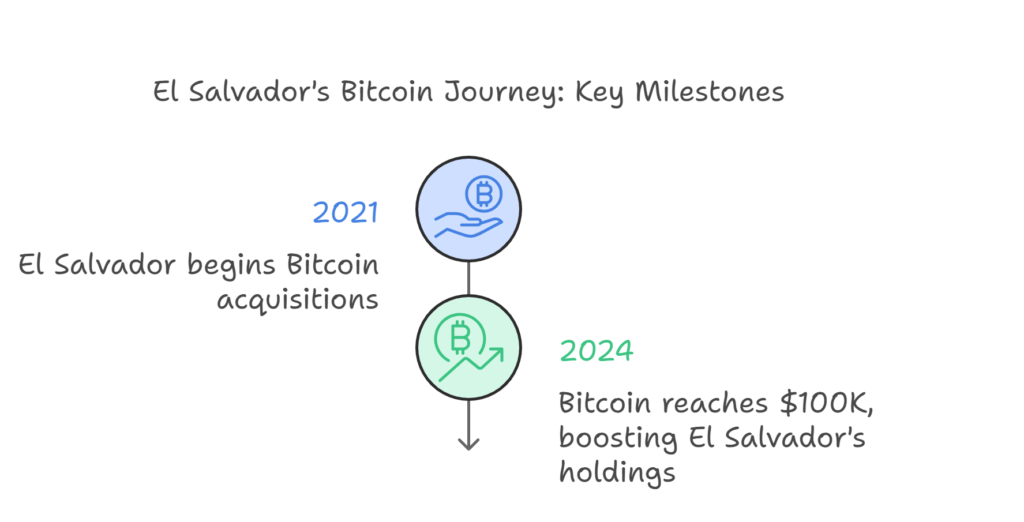

In September 2021, El Salvador became the first country to officially adopt Bitcoin as legal tender alongside the U.S. dollar. Spearheaded by President Nayib Bukele, the move was met with both global praise and backlash. Critics raised concerns about the volatility of Bitcoin, while supporters hailed it as a step toward financial inclusion, independence, and modernization.

Over the last two years, El Salvador has steadily accumulated Bitcoin, buying during both market peaks and troughs. Despite initial resistance from international organizations such as the IMF and skepticism from domestic sectors, the country has stayed unwavering in its commitment. Now, with Bitcoin’s price soaring past $100,000, El Salvador’s Bitcoin wallet is generating significant returns, yielding a much-needed boost to its economy.

Breaking Down the $300M Profit

According to official data, El Salvador has purchased an estimated 2,381 Bitcoins since 2021, spending roughly $108 million on these acquisitions. With Bitcoin hitting $100K, the market value of these holdings has skyrocketed to approximately $238 million, translating to a massive $300 million in unrealized gains. These figures reflect the immediate paper profitability of El Salvador’s Bitcoin strategy, raising discussions about the sustainability and potential reinvestment of these gains into the country’s development.

It’s worth noting that these profits are still unrealized. Should Bitcoin’s value face another correction or crash, the government could encounter economic risks similar to the criticisms originally voiced by financial experts. Nevertheless, the current numbers are an undoubted win, bolstering President Bukele’s narrative that Bitcoin can serve as a transformative economic asset.

How Bitcoin’s Surge Impacts El Salvador’s Economy

The Bitcoin rally has significant implications for El Salvador, one of the best-performing crypto pioneers in the developing world. With a $300 million profit margin, the government has the potential to reinvest these funds into infrastructure, healthcare, education, and initiatives aimed at improving the lives of its citizens.

During the early days of Bitcoin’s adoption, the establishment of “Chivo Wallets” allowed citizens to transact using Bitcoin without incurring high remittance fees—a move that provided financial relief to countless Salvadorans. The additional profit from soaring prices could further enhance these services or fund cutting-edge technologies to integrate blockchain into more governmental and societal functions.

Moreover, these gains are likely to bolster El Salvador’s growing tourism appeal. President Bukele has heavily marketed Bitcoin adoption as an innovation story, attracting cryptocurrency enthusiasts, investors, and even businesses eager to operate within the digital financial ecosystem. The country is also working on initiatives like the planned Bitcoin City and Volcano Bonds, reinforcing its identity as a global crypto hub.

Bitcoin’s Price Milestone: A Key Driver

Bitcoin’s price hitting $100K has sent ripples across the financial world. This historic milestone has been driven by multiple factors, including increasing institutional adoption, growing global interest in cryptocurrencies as an inflation hedge, and sustained enthusiasm among retail investors.

The cryptocurrency market has seen surges before, but the symbolic six-figure mark for Bitcoin signals deeper market maturity. Companies, governments, and financial institutions are increasingly integrating Bitcoin into their portfolios, lending the digital asset further credibility as a global store of value. For investors in emerging markets, such as El Salvador, these dynamics offer both rewards and challenges.

Global Reactions to El Salvador’s Bitcoin Bet

El Salvador’s success story has invited a renewed wave of attention from nations considering their own approaches to cryptocurrency regulation and adoption. Leaders in Latin America, Africa, and Southeast Asia are closely observing how Bitcoin’s success translates to tangible development outcomes in El Salvador.

However, ongoing criticisms remain. Economic skeptics argue that the country’s reliance on Bitcoin exposes it to severe financial instability, particularly if the market faces another bear cycle. Others highlight the need for stronger protections for citizens who still lack robust digital literacy or access to necessary infrastructure to fully benefit from such initiatives.

The Future of Crypto-Driven Economies

As El Salvador revels in its $300 million profits, other countries are considering how they might follow suit or adapt Bitcoin-related policies to their needs. Still, the future of crypto-driven economies depends on the sustained growth and stability of the cryptocurrency market itself. El Salvador’s example underscores the potential rewards, but it also serves to remind other nations that the road to Bitcoin adoption is far from risk-free.

Notably, the Bitcoin milestone also raises questions about global financial equality. With the digital currency offering opportunities for wealth creation, some see it as a tool to level the playing field. Others, though, stress the importance of ethical frameworks to ensure vulnerable populations are protected from volatility-related risks.

What This Means for Traders and Investors

For traders and investors tracking Bitcoin’s wild journey, El Salvador’s story has become a case study in high-stakes economic strategy. The nation’s bold embrace of cryptocurrency offers valuable lessons about navigating both opportunities and risks in emerging markets. As Bitcoin hits $100K, traders are reminded of the immense growth potential inherent in the cryptocurrency market—but also of the importance of managing speculative bubbles and volatility.

For more expert insights and analysis on Bitcoin’s performance and its global impact, be sure to check out additional resources available on MetaCandle.net, your go-to platform for financial news and updates.

Conclusion: Bitcoin Hits $100K—A Victory for El Salvador?

Bitcoin hitting $100K is not just a market milestone; it’s a pivotal moment for the cryptocurrency’s role on the global stage. For El Salvador, the resulting $300 million in unrealized gains offers validation of its bold Bitcoin gamble while sparking discussions about the future of digital assets in national economies. While challenges remain, this achievement cements Bitcoin’s power to act as a transformative financial tool.

As the world watches El Salvador’s progress, one thing is clear: the cryptocurrency revolution is far from over, and milestones like Bitcoin hitting $100K are only the beginning of what could be a groundbreaking financial shift for nations bold enough to embrace it.

Responses