Bitcoin ETFs Drive $6.46B Inflows Amid 45% BTC Price Surge

How Bitcoin ETFs Are Impacting the Crypto Market

Bitcoin ETFs have long been awaited by investors who are looking for accessible and regulated methods to gain exposure to Bitcoin without directly purchasing or managing the cryptocurrency itself. This increased accessibility has unlocked a new wave of institutional investment, solidifying Bitcoin’s position in mainstream finance.

The $6.46 billion inflow into Bitcoin ETFs over recent weeks signals growing confidence among institutional investors, as well as an eagerness to capitalize on Bitcoin’s extraordinary price surge. With Bitcoin rallying 45% in just a few weeks, the interaction between Bitcoin ETFs and market activity is creating a feedback loop, further driving up prices.

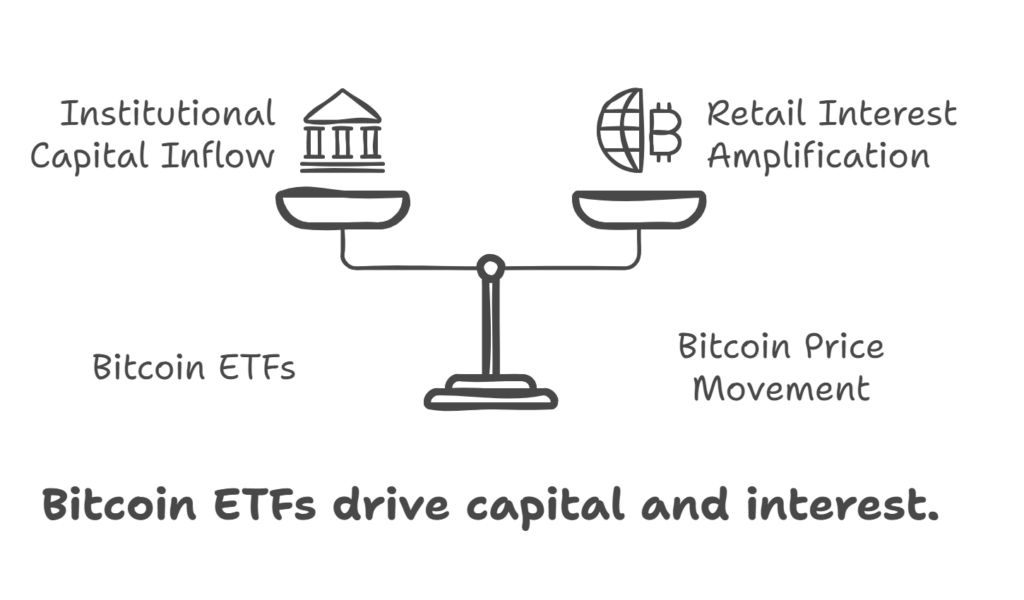

Understanding the Relationship Between Bitcoin ETFs and BTC Price Movement

The relationship between Bitcoin ETFs and Bitcoin’s price is both direct and indirect. On one hand, Bitcoin ETFs act as a gateway for institutional capital, leading to increased demand for BTC and pushing prices higher. On the other hand, the buzz surrounding Bitcoin ETFs themselves serves to amplify retail interest, creating broader participation in the market.

As the market matures, Bitcoin ETFs are poised to play an even larger role in shaping price trends and investor sentiment. Analysts expect regulatory clarity around ETFs to fuel further inflows, setting the stage for a continued bull run into 2024 and beyond.

What Is Driving $6.46 Billion in ETF Inflows?

Beyond the allure of Bitcoin’s price surge, a combination of macroeconomic and crypto-specific factors are driving the massive inflows into Bitcoin ETFs. Let’s explore the primary catalysts:

1. Regulatory Progress in Key Markets

Recent approval for Bitcoin ETFs in regions such as North America and parts of Europe has unlocked new markets for institutional investors. This has bolstered confidence in the long-term viability of Bitcoin ETFs as an asset class. Additionally, clearer regulations have fostered trust among entities historically cautious about entering the crypto space.

2. Institutional Demand Surges

Institutions have been steadily increasing their exposure to Bitcoin, particularly as macroeconomic uncertainty mounts. Bitcoin ETFs offer an avenue for large-scale, compliant investment, enabling institutional players to participate without encountering the complexities of direct crypto holdings. The recent inflows reflect this growing confidence and recognition of Bitcoin as a hedge in uncertain times.

3. Bitcoin Halving and Market Anticipation

With Bitcoin’s next halving event less than a year away, enthusiasm is building about the potential supply shock that could further drive up prices. Bitcoin ETFs have become an appealing way for investors to position themselves for what many expect to be a historic bull run.

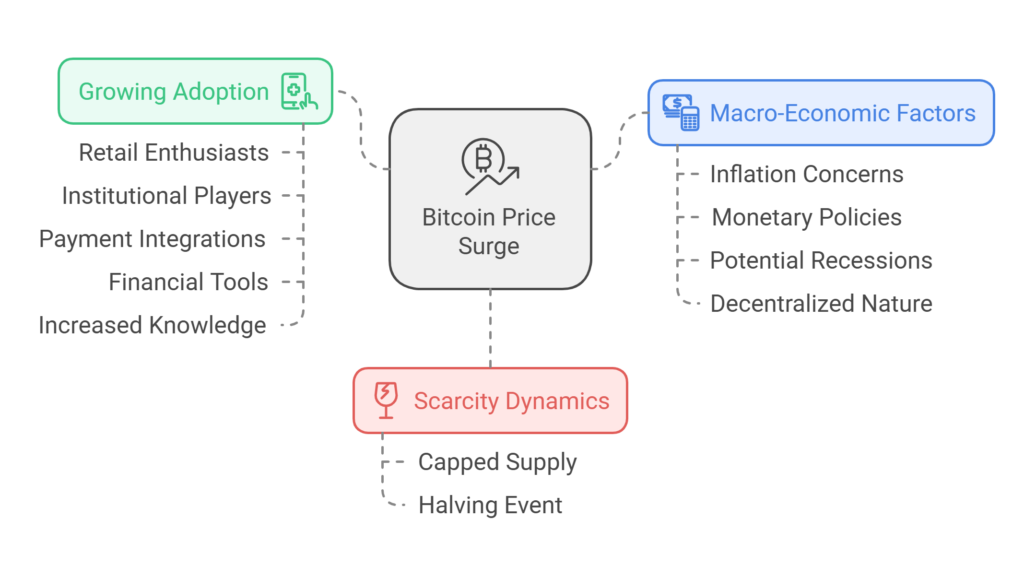

How the 45% Price Surge Reflects Bitcoin’s Growing Maturity

Bitcoin’s recent price surge is about more than just speculation—it’s a reflection of Bitcoin’s growing acceptance as a legitimate asset class. Here are some of the underlying factors behind the 45% uptick in BTC price:

1. Growing Adoption

Widespread adoption among retail enthusiasts and institutional players alike has boosted Bitcoin adoption rates worldwide. Payment integrations, financial tools, and increased knowledge about Bitcoin’s potential are all pushing the adoption curve upward. This growing adoption provides a solid foundation for Bitcoin prices.

2. Macro-Economic Factors

Amid increasing concerns around inflation, monetary policies, and potential recessions, Bitcoin is emerging as a hedge against traditional financial uncertainty. Investors are finding solace in Bitcoin’s decentralized nature, further fueling its upward trajectory.

3. Scarcity Dynamics

Bitcoin’s capped supply of 21 million coins ensures limited availability—an aspect that is increasingly attracting both small and large investors. The approaching halving event will further exacerbate scarcity, offering strong price support.

What Lies Ahead for Bitcoin ETFs and BTC Price?

As we head toward the final months of 2024, the role of Bitcoin ETFs in crypto markets is expected to grow even more pronounced. Market analysts predict continued inflows into ETFs, with projections exceeding $10 billion by Q1 2024. This increase could lead to further price rallies, potentially pushing Bitcoin beyond its previous all-time high.

The interplay between Bitcoin ETFs and the broader crypto ecosystem is laying a strong foundation for future growth. As regulatory frameworks solidify and market sentiment strengthens, Bitcoin is primed for an extended period of bullish activity.

Conclusion: Bitcoin ETFs as a Catalyst for a Bitcoin Revolution

Bitcoin ETFs are more than just a financial product—they represent a gateway for mainstream investors to participate in the cryptocurrency revolution. Recent ETF inflows of $6.46 billion and a 45% price surge for Bitcoin underscore the evolving dynamics of the market, fueled by institutional demand and macroeconomic conditions.

As we move closer to significant milestones such as Bitcoin’s next halving, the continued rise of Bitcoin ETFs will likely serve as a cornerstone for broader adoption. To stay ahead of market trends and deep dive into crypto news, visit metacandle.net for comprehensive insights and updates.

Responses